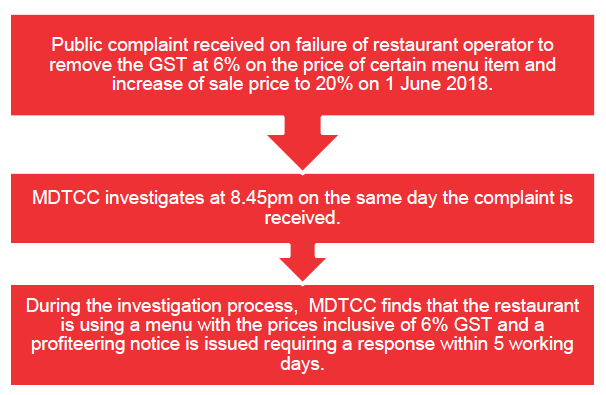

This research is essentially a library based doctrinal research whereby the materials used are obtained from libraries archives and other databases. After 11550 business premises were inspected throughout the state the Sarawak Ministry of Domestic Trade and Consumer Affairs KPDNHEP recorded 103 cases compound value amounting to RM12900 under the Price Control and Anti -Profiteering Act 2011.

The item ASM - Price Control and Anti-Profiteering Act 2011 Act 723 electronic journal represents a specific individual material embodiment of a distinct intellectual or artistic creation found in Sydney Jones Library University of Liverpool.

. With the Price Control and Anti-Profiteering Act 2011 PCAPA. Short title and commencement 1. YUSOFF 802293 A thesis submitted to the Ghazali Shafie Graduate School of Law Government and International Studies in fulfillment of the requirements for the Degree of Master of Law Universiti Utara Malaysia.

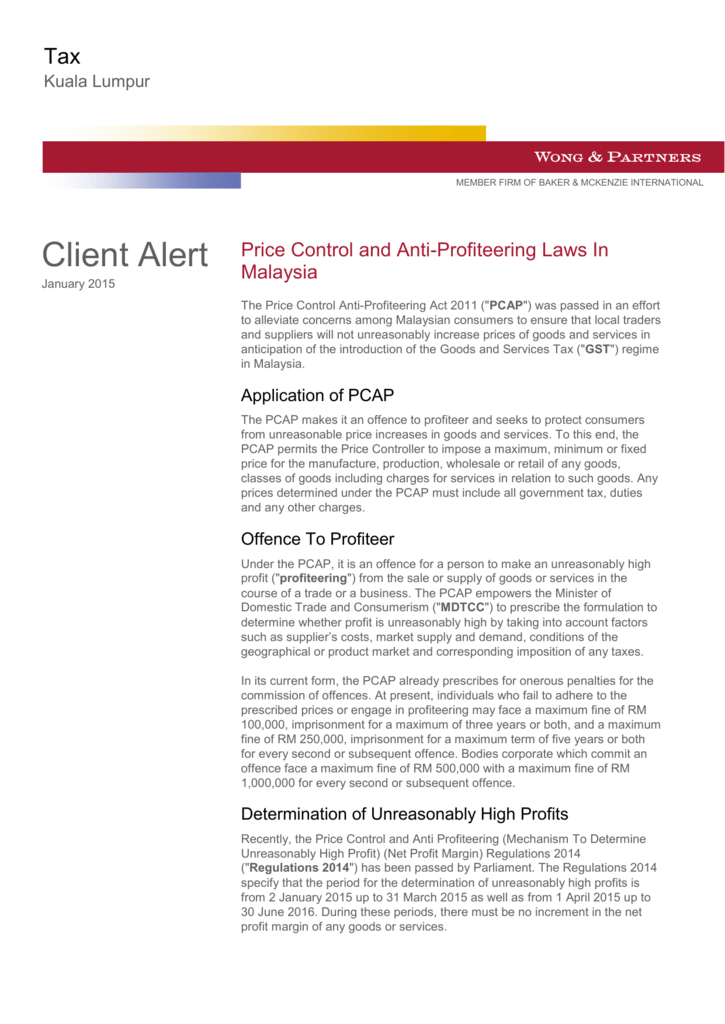

Price Control And Anti Profiteering Act 2011. For corporate bodies a maximum fine of RM1000000 can be imposed for such offence. In addition to that this study also explains why the government abolished the Price Control Act 1946 and introduced the Price Control and Anti Profiteering Act 2011.

Section 3 of the principal Act is amended by substituting for subsection. Government To Remove Ceiling Prices For Chicken And Eggs Subsidies For Bottled Cooking Oil. Reviews 0 Reviews There are no reviews yet.

Load More Most Viewed Articles. When GST is implemented there may be cost savings to the business since business can claim back GST incurred on the inputThe Government has enacted the Price Control and Anti-Profiteering Act. The Price Control and Anti-Profiteering Act 2011 Act 723 which is referred to as the principal Act in this Act is amended in section 2 in the definition of authorized officer by inserting after the words public officer the words or officer of a local authority.

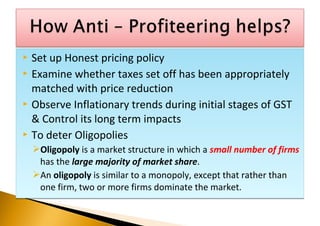

The purpose of the Act is to enable the Government to determine prices of goods or charges for services with the object of curbing excessive profiteering of essential goods and services by unscrupulous traders. The Price Control and Anti-Profiteering Act 2011 prescribes that any corporate body who commits an offence of profiteering shall on conviction be liable to a fine of up to RM500000 and for a second or subsequent offence to a fine not exceeding RM1000000. The Government recently enacted the Price Control and Anti-Profiteering Act 2011 Act which came into force on 1 April 2011.

1 this Act may be cited as the price control and anti-profiteering Act 2011. These materials are used to. The Resource ASM - Price Control and Anti-Profiteering Act 2011 Act 723 electronic journal.

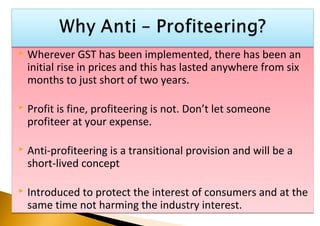

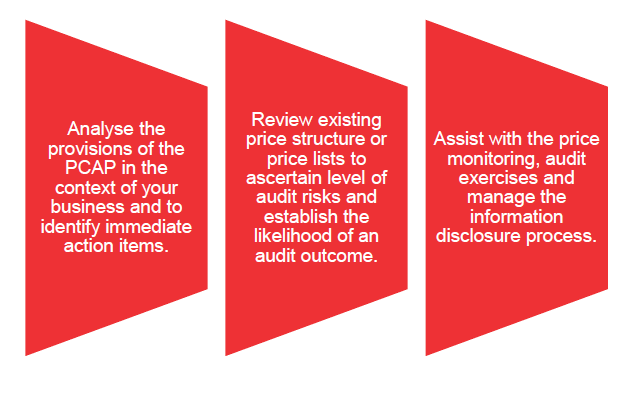

Under the PCAP profiteering is an offence. A STUDY ON THE PRICE CONTROL AND ANTI PROFITEERING ACT 2011 IN CONTROLLING THE PRICE OF GOODS ROSNELIM BT. The PCAPA seeks to penalise businesses that make unreasonably high profits arising from the implementation of GST.

Nur Adilah Ramli - 22nd June 2022. Be the first to review PRICE CONTROL AND ANTI-PROFITEERING ACT 2011 ACT 723 REGULATIONS ORDERS Cancel reply. An Act to amend the Price Control and Anti-Profiteering Act 2011.

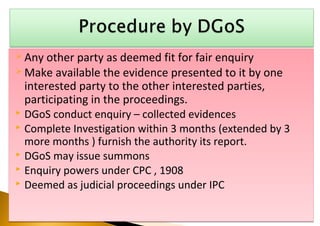

Best Fixed Deposit Accounts In. Where such person is not a body corporate he shall be liable to a fine of not. Ministry of Domestic Trade Cooperative Consumerism MDTCC.

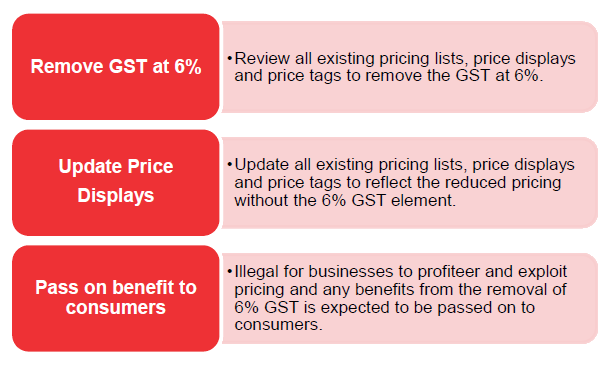

The Price Control Anti-Profiteering Act 2011 PCAP was passed to protect consumers in Malaysia against unreasonable increase in prices of goods and services following the introduction of the Goods and Services Tax GST regime in Malaysia. 2 Bill Amendment of section 3 3. A STUDY ON THE PRICE CONTROL.

The Government recently enacted the Price Control and Anti-Profiteering Act 2011 Act which came into force on 1 April 2011. The cases were recorded from Feb 5 to 10 June 10 this year during the. 2This Act comes into operation on a date to be appointed by the Minister by notification in the Gazette.

2 of this Act come into force on such date as the Minister may by notification in the Gazette and the Minister may set different dates for the commencement of different provisions in this Act. Noncompliance with the formulas under the new regulations would technically tantamount to having unreasonably high profit This in turn would constitute an offense under the current provisions of the Price Control and Anti-Profiteering Act 2011 for which the penalties upon conviction in court are as follows. Profiteering is defined as making an unreasonably high profit which is measured by a mechanism prescribed in the Price Control and Anti Profiteering Regulations PCAPR.

The first PCAPR came into effect on 1 January 2015 and was replaced by the PCAPR 2016. PRICE CONTROL AND ANTI-PROFITEERING ACT 2011 ACT 723 REGULATIONS ORDERS quantity. This item is available to borrow from 1.

The government will remove the ceiling prices for chicken and eggs and subsidies for bottled cooking oil 2kg 3kg and 5kg from 1 July 2022. The Price Control and Anti-Profiteering Act 2018 makes it an offence to profiteer. ENACTED by the Parliament of Malaysia as follows.

Price Control and Anti-Profiteering Act 2011. The purpose of the Act is to enable the Government to determine prices of goods or charges for services with the object of curbing excessive profiteering of essential goods and services by unscrupulous traders. The current iteration of the PCAPR.

1 This Act may be cited as the Price Control and Anti-Profiteering Amendment Act 2017. The PCAP is administered by the Ministry of Domestic Trade. June 13 2022.

Price Control And Anti Profiteering Laws In

Anti Profiteering Laws In Malaysia Zerorisation Of Gst Leading To Greater Scrutiny On Pricing Lexology

The Price Control And Prevention Of Profiteering And Hoarding Act 1977

Price Control And Anti Profiteering

Price Control And Anti Profiteering Act 2011 Act 723 Regulations Orders Marsden Professional Law Book

Pdf Profiteering And The Degree Of Monopoly In The Great Recession Recent Evidence From The United States And The United Kingdom

Businesses Beware Of Price Control And Anti Profiteering Act Cheng Co Group

Anti Profiteering Laws In Malaysia Zerorisation Of Gst Leading To Greater Scrutiny On Pricing Lexology

1 Nov 2018 Budgeting Inheritance Tax Finance

Price Control And Anti Profiteering Mechanism Extended To All Goods And Services In Malaysia Rahmat Lim Partners

Anti Profiteering Laws In Malaysia Zerorisation Of Gst Leading To Greater Scrutiny On Pricing Lexology

Pdf Price Control And Anti Profiteering Laws Of Malaysia Act 723 Price Control And Anti Profiteering Act 2011 Tadasrid Td Academia Edu

Price Control And Anti Profiteering Mechanism Extended To All Goods And Services In Malaysia Rahmat Lim Partners